The Bank Diaries

Wiki Article

The Ultimate Guide To Bank Draft Meaning

Table of ContentsBank Definition for DummiesUnknown Facts About Bank Account NumberMore About Bank AccountGetting The Banking To WorkThe Main Principles Of Bank Certificate Getting The Bank To WorkGet This Report on Bank Code

This helps you purchase the points you need and it likewise aids the economy expand, possibly treking inflation. Reduced passion rates on company lendings indicate that firms can borrow money a lot more cheaply and also hence have accessibility to more money, making them likely to spend more money to employ staff members, claim, or rise wages.People as well as organizations typically spend less and save more when rate of interest prices are high, which aids to reduce the economy as well as commonly leads to depreciation. Depreciation can make borrowing much more costly as well as the task market a lot more affordable, yet it offers your dollars much more acquiring power. Keeping the economic climate from not getting too hot and too cool audios stealthily basic.

The offers for monetary products you see on our system originated from business who pay us. The cash we make aids us offer you accessibility to complimentary credit report as well as reports and aids us produce our other fantastic tools and also academic materials. Compensation may factor right into exactly how as well as where products appear on our platform (and in what order).

All about Bank Code

That's why we supply features like your Approval Chances and also cost savings price quotes. Certainly, the offers on our system do not represent all monetary items out there, but our objective is to reveal you as many wonderful choices as we can. Also a single kind of financial institution might use various kinds of bank accounts, consisting of monitoring, savings as well as cash market accounts.However they typically partner with a conventional bank that holds customers' deposits and manages the behind the curtain funds. There are a couple of exemptions, though on-line financial institutions are beginning to get approved for nationwide charters or acquiring little financial institutions that already have a national charter. bank statement. And typical brick-and-mortar financial institutions can use online-only savings account or produce online-only bank brand names.

Unlike banks, which are solely possessed by investors, clients and investors can equally have a second hand. Historically, there were restrictions on the sorts of products a second hand could supply. Today, you may locate that thrifts and also banks supply similar kinds of consumer accounts. Yet federal regulations have commonly limited the kinds of commercial accounts as well as business lendings they might join.

8 Simple Techniques For Bank

And financial institutions make a lot of their money from the rate of interest and also charges on the lendings they issue. There are some economic establishments that supply financings yet do not accept down payments and also aren't financial institutions. Typical examples consist of nonbank home mortgage loan providers as well as payday lending institutions. view it now Online, you can additionally discover consumer and small business lendings from nonbank lenders and also peer-to-peer borrowing systems.But in basic, you'll wish to make certain your account is guaranteed by either the FDIC (for banks) or NCUA (for lending institution). The insurance policy hides to $250,000 in down payments, which stands as a government warranty that you'll obtain your cash if the bank or lending institution goes under.

Louis De, Nicola is a personal money author as well as has created for American Express, Discover and also Nova Credit Rating. Along with being a contributing author at Credit history Karma, you can discover his work with Company Insider, Cheapi Find out more..

Things about Bank

Validate your identity in the app currently to Log In to Online Banking. Please use your Customer ID/Password to Log In.

In regards to banks, the reserve bank is the head top dog. Reserve banks handle the cash supply in a single country or a series of nations. They oversee industrial financial institutions, established rate of interest and manage the flow of currency. Central banks likewise carry out a federal government's monetary plan objectives, whether that involves combating deflation or keeping costs from rising and fall.

Fascination About Bank Account

The shadow financial system is composed of financial teams that aren't bound by the exact same stringent guidelines and laws that other banks need to follow. Much like the standard regulated financial institutions, darkness financial institutions take care of debt and also various type of assets. But they obtain their funding by obtaining it, getting in touch with investors or making their very own funds as Look At This opposed to making use of money issued by the reserve bank.

Cooperatives can be either retail financial institutions or business banks. What differentiates them from other entities in the financial system is the truth that they're commonly regional or community-based bank error organizations whose members assist identify just how business is operated. They're run democratically as well as they supply finances as well as banks accounts, amongst various other things.

Rumored Buzz on Banking

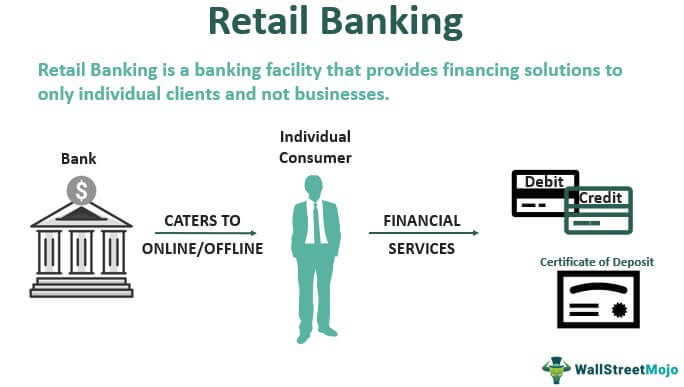

Like financial institutions, credit report unions issue finances, offer financial savings and examining accounts and satisfy various other monetary requirements for customers and organizations. The difference is that banks are for-profit firms while credit history unions are not.In the past, S&Ls mainly functioned as cooperative organizations. Participants took advantage of the S&L's solutions and made more rate of interest from their savings than they might at business financial institutions. For a while, S&Ls weren't controlled by the federal government, yet now the federal Workplace of Second hand Supervision supervises their task. Not all financial institutions serve the exact same objective.

Get This Report about Bank Statement

It doesn't occur with one transaction, in one day on the job, or in one quarter. It's earned relationship by relationship.Report this wiki page